If you would like to read from the beginning, here’s a link back to the very first post I made.

https://wallstreetbroker.wordpress.com/page/11/

It almost feels like I have been living a dream, a bubble away from the rest of the world. In the past few months, I’ve neglected a lot of things I used to do, created a new life outlook, and finally for the first time in ages, my direction in life appears a lot more clearly to me.

People think I’m absolutely crazy for giving up so soon after all this hard work. I have to remind them, I don’t give up. I simply move on. It’s not even that bad though, most of my time was spent investing in getting licensed. Lets not forget I am quite certain I broke the trainee record for taking the most practice examinations, over seventy. I was THAT dedicated. There will be lots of disappointed people. I think many people bet that I would be one of the trainees that would really make it. I’d like to believe that everyone had a good opinion of me, at least as far as I know, my conversations with them were never awkward or forced.

At the firm, I never showed a moment of weakness and I acted like a machine. No feelings, no personal problems, just mold me. My nickname there was “Rockstar” because I would drink so many Rockstar energy drinks to get that physical edge I needed everyday. Some guys joked about how I already looked like a broker before I was a broker.

So it was with a heavy heart when I called in this morning and said I want to resign from my position at the firm. Not quit, since that has such a negative connotation…but resign. The recruiting assistant asked me why, and I gave her a vague reply – “personal circumstances.” I drafted a quick letter of resignation and emailed it to her. Just like that, a door that was open to me, closed shut in my face. You know that expression that goes something like ‘it takes years to build, but seconds to destroy’? That’s basically what happened here, although obviously not years but months. I remember that first week when I was told that only a handful of people would make it in the long term. Well, I just became a statistic.

Before I get TOO negative and yes it will get very negative, I want to talk about the POSITIVES of this firm. This firm has helped me build a work ethic that’s second to none and has awakened a drive in me to succeed that I never thought I had in me. It has also helped me see a side of people and a side of Wall Street that I’ve never seen before. The techniques at this firm do help you become rich if you have the willpower to tough it out. Depending on what broker team you join, and if you fit in, you can build an enjoyable career here. The location is amazing, the office is amazing, and the money has the potential to be amazing. I have no doubt that this firm is going places. You’ll see it more and more in the news and it will be in a movie and a television show. The CEO is a megalomaniac with huge ambitions, and any company would do well to have a CEO that proactive and motivated.

I have tried to pinpoint the reasons why I wanted to leave the firm. There’s no point in working a few weeks to try it out. This negativity I have right now would strongly affect the way I work and pitch. I have shortened it down to three reasons. Before I continue, I want to apologize for using this list format because it seems so arbitrary, but I assure you I am being genuine as to why I am resigning today. Time to unveil it all.

1. “We’re not wealth managers, we’re stockbrokers.”

This is a quote from my senior broker which I used in a post a few days ago. This is a huge problem for me. The kind of work they do here seems really elementary. I don’t want to just be a salesman trying to shove stuff down some guy’s throat. I’d rather take my time to actually help my clients make money rather than help them speculate on stocks that I don’t believe in, but I am forced to pitch with hammy sounding scripts. I thought about it and I’d rather be a wealth manager than a salesman who sells stock. I don’t care about the huge commissions anymore because it’s really a huge fraud. The next two reasons will explain what I mean.

2. This is a career, not a job.

When I first started, I wanted to believe that I could be with this firm for years. To rookies in the business, this is not exactly the kind of position where if you leave a few years later, you can transfer elsewhere and be fine. If you leave to another company or to start your own brokerage, this firm may end up taking a few of your clients. Years of work could be flushed down the drain. The work ethic and working style at this firm is so unlike anywhere else, you would have trouble fitting in at another company. If you wanted to do a career change, there’s not exactly much you can put on the resume nor is there much in the way of transferable skills, except for maybe some soft skills. Work is basically three simple steps; you cold call with scripted pitches, open accounts, and do a few trades. There’s really nothing complicated about this business. That’s why idiots with no college education can succeed in selling stock.

I couldn’t see myself at this firm working these hours doing the kind of work that I’m doing in the next 5 years. Therefore, what’s the point if I see myself leaving?

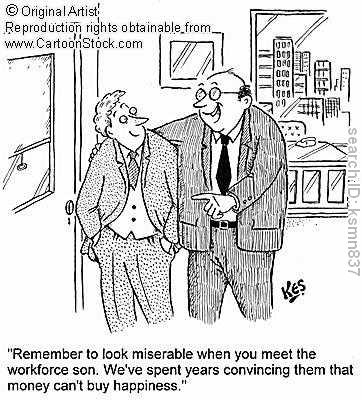

3. I don’t like the way my team/the company conducts business. MOST IMPORTANT.

Half the brokers here never make their clients any money in the long term. If they were so smart and could pick such good stocks, why don’t they use their own money and trade for themselves? The reason is that their job is not to make their clients money. Their job is to produce and make commissions for themselves and for the firm. Our firm charges huge commissions and the payouts are pretty huge for senior brokers. Many of them have the ability to convince people who have portfolio losses of 50% to send even more money. This job all comes down to arguing with people to send you tons of money so you can discreetly churn their accounts and make money while they lose money. However, you can take the high road and not partake in these questionable tactics, but then you won’t make much money. When you work double the hours of a normal workday and get pushed everyday to be a big producer, it will eventually be really difficult to charge clients the minimum commission and not make trades for the sake of making money for yourself.

Compliance here warned all the trainees about churning accounts when we start doing business as stockbrokers. However, many senior brokers here CHURN ACCOUNTS hitting clients with 3% in and 3% out and 7% on private placements that can lose people 100% of their money! That’s why they can make $100, 000+ a month. The CEO of my firm has an alarming FINRA profile which accuses him of churning, fraud, breach of contract, and other violations.

Most of the time, if you’re doing business with the brokers at my firm, you’re gambling. Rich people are so rich, they don’t mind gambling some of their money, and it inevitably leads to huge losses. In our pitch, we make it seem like we’re going to share a recommendation with the client that seems tailored for them. In fact, most brokers just sell whatever our chief market analyst tells us to sell. Most of them don’t know shit about securities or the intricacies of the market. They just memorize a pitch and make it sound good, then it’s either buy or sell. I read somewhere a firm did a study on why people do business with their broker and it’s not because they make money, their #1 answer is because “I like him!”

You know that movie “Boiler Room”? This firm is almost exactly the same way but we’re presenting legitimate listed stocks. We’re also using boiler room aggressive tactics and pitches to convince prospects that this is something they need. That’s not exactly a crime, but anyone who does any reading on financial news or perform any due diligence will realize our pitches are fucking bullshit. There’s a reason we don’t pitch ANY people who work or have worked in the financial industry. We hype up a house stock and we pitch it to people, using irrelevant facts, irrelevant names, misleading figures, and honestly that’s not the way to buy stocks if you want to try to make money. I call 600 people a day in the hopes that one idiot out there will buy into what I’m saying. I don’t believe in it, so how I can help others believe in it? This is not something I want to do in a career, and as long as I’m surrounded by people who do this, I will probably be unhappy.

If this kind of technical analysis and boiler room stuff really worked in making investors good money, why is the richest active investor on this planet, Warren Buffett, doing stuff that we’re NOT doing? In fact, why are most great investors not doing what we’re doing? There’s a difference between “investing” and what we do, which is run a stock market casino.

My team doesn’t even practice what they preach. They tell me to be loud, aggressive, and relentless. However, sometimes I catch them slacking and sounding really boring on the phone. Honestly, when I work here I feel like I’m becoming retarded. A lot of people around me really don’t know much about ANYTHING except buy and sell. There has to be a better way to become wealthy or at least a smarter organization to work for. I’m not trying to be a pretentious smart ass and tell people how to work or how to run a company, I only know what’s best for me now and what may be best for my future.

To people getting into the brokerage business. Do not invest your soul into a hotshot firm that’s telling you to work as a stockbroker because you can get rich quick. That’s not a good reason to become a stockbroker, because there are many other ways to be wealthy. Make sure you love every aspect including the people and the firm itself.

“Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.” – Warren Buffett

Life is simple, you make choices and you don’t look back.